Key Takeaways:

Guyana has experienced FX shortages in the pre-oil and post-oil periods.

Oil revenues do not enter the Guyanaese economy, but are spent overseas for the purchase of imports.

The government creates Guyana dollars when it spends on domestic services and transfers, among others.

When these created Guyana dollars remain define, they worsen FX shortages, especially since newfound oil raises public demands for more government spending.

Reforms involving fiscal-monetary coordination are necessary to prevent worsening FX shortages.

The Guyanese press has warned of possible foreign exchange (FX) shortages since the discovery of large quantities of offshore sweet crude, highlighting a supposed paradox of plenty in which the country is earning unprecedented amounts of American dollars (foreign exchange) and yet several business owners have regularly complained about having to join queues to obtain the foreign currency needed for importing many commodities and services.

However, since the 1950s, economists have observed FX shortages in developing economies and in relatively more advanced emerging market economies. These shortages are known as an FX constraint among economists, because of the view that the inability to earn US dollars restricts long-term economic growth. 1 Indeed, I published an academic study in 2009 showing that such a constraint existed in pre-oil Guyana. 2 The objective of the study was to determine whether Guyanese banks were unable to convert their Guyana dollar excess reserves, which paid a zero interest rate, into US dollar foreign assets. The study found a statistically significant relationship between the Guyanese FX constraint and excess bank reserves.

Nevertheless, the present shortages in an economy that earns unprecedented levels of foreign currency from oil exports (thus the paradox of plenty) need further exploration. As of March 31, 2025, Guyana has had USD $3.34 billion in the Natural Resource Fund (NRF). 3 Meanwhile, the Bank of Guyana (BoG), Guyana’s central bank, held USD $1.02 billion in international (or foreign) reserves at the end of June for the same year, and commercial banks held USD $0.458 billion in net foreign assets. 4 These three stocks or savings of foreign currency serve different purposes.

First, the FX reserves of the BoG serve to manage the exchange rate, given that Guyana has a managed exchange rate, which has gradually depreciated in the past 24 months. The BoG intervenes in the FX market to steer the rate in a particular direction by buying or selling foreign currency. FX intervention is a tool of monetary policy in many developing countries, similar in spirit to the United States Federal Reserve’s intervention in the interbank market to steer its benchmark interest rate in a given direction. The slight depreciation of the average market rate likely reflects the government’s fear of a strong currency, which is partly associated with the Dutch Disease (DD), as the local media reported.5

A brief note on the Dutch Disease is in order. At its most basic level, the DD has its roots not only in the domestic FX market but also in the domestic markets for goods and services. The DD results when Guyana’s exchange rate gains strength (appreciates) against the country’s main competitors. Similarly, when Guyanese costs of production and prices grow faster than those of competitors, we have the second source of the DD from the market for products and services. In essence, the DD is a situation in which one country (Guyana) loses international competitiveness relative to trading.

Consequently, the BoG has been reluctant to allow the exchange rate to appreciate, preferring instead a gradual or crawling depreciation. This policy requires rationing foreign currency. Rationing implies that the central bank may place importers in a short queue by ensuring that demand exceeds supply for brief periods.

Second, legislation prohibits the use of the NRF for exchange rate management, a task that is independent of parliamentary action. Exchange rate management implies active interventions in the FX market. On the other hand, the NRF is the nation’s savings account, which is invested in safe assets such as US Treasuries, notwithstanding recent debates relating to the long-term viability of the dollar as a safe haven. Moreover, withdrawals from the Fund are subject to parliamentary oversight and debates. The withdrawals have been used to fund major capital expenses of the government, especially physical infrastructure. It is not only illegal, but also poor policy, to use withdrawals from the NRF for active monetary policy. Any mixing of the funds in the NRF and the BoG’s foreign reserves will result in less governmental transparency.

Third, the net foreign assets (NFAs) of Guyanese commercial banks are intended for transaction purposes, such as when a customer writes a manager’s check to make an overseas payment. The check of the Guyanese bank customer (the importer) will be cashed using the bank’s overseas account and paid to a foreign vendor. In this transaction, the Guyanese importer pays the commercial bank in Guyana in Guyanese dollars, while the foreign bank makes the overseas payment on behalf of the importer. It should be noted that the NFAs and BoG foreign reserves are part of the available supply of foreign currencies.

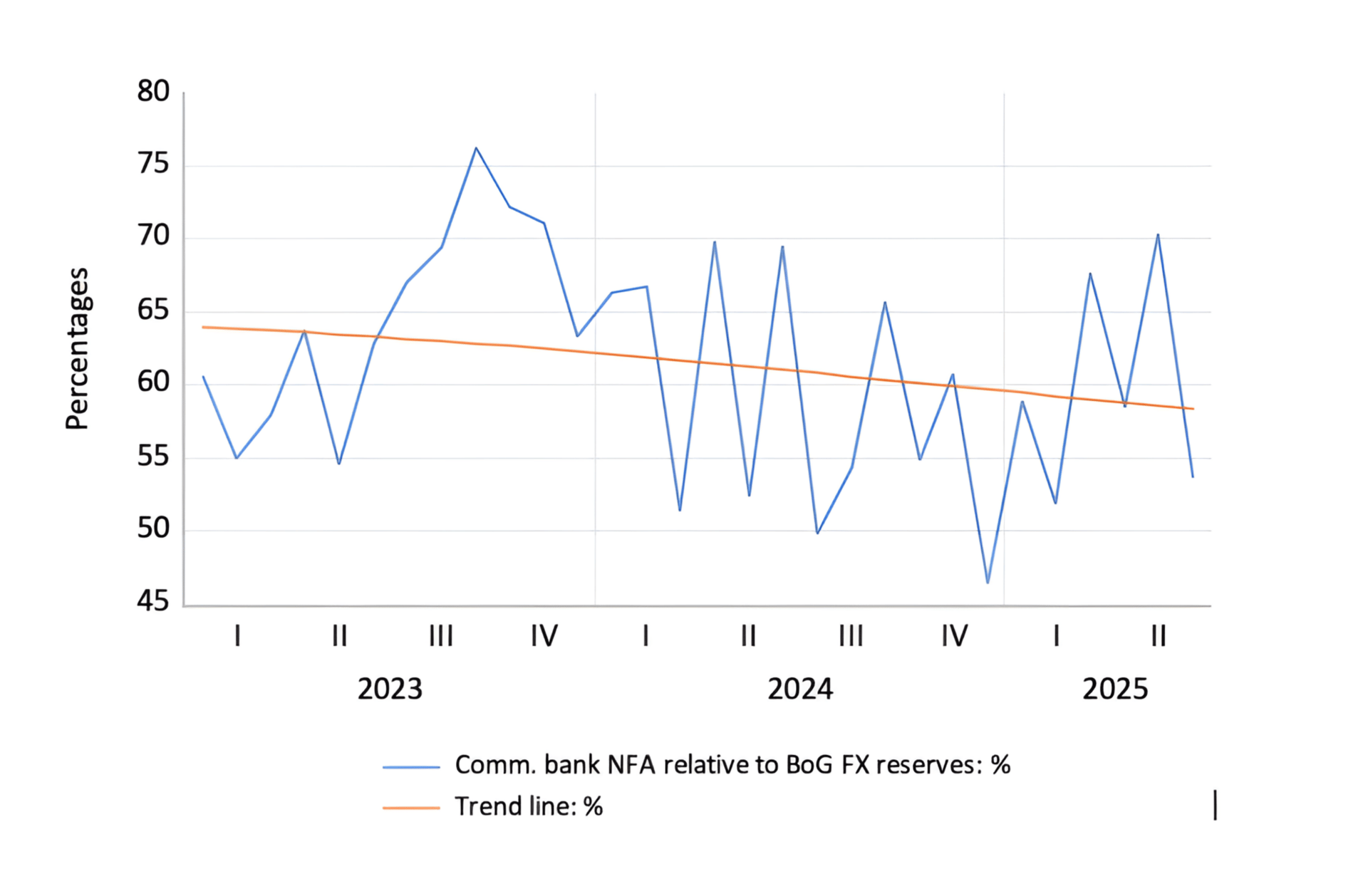

Figure 1 - Percentage of Commercial Banks’ NFA Relative to BoG’s International Reserves

Source: Author’s calculation using data from the Bank of Guyana

If the commercial banks’ NFAs are used for Guyanese overseas transactions, then the trendline in Figure 1 should be flat. As we can see, there is a downward trend from January 2023 to June 2025 despite multiple attempts by the BoG to sell foreign exchange in the local market. From January to June 2025, the BoG sold USD $583 million in the local FX market, as well as USD $322.8 million for the entire year of 2024, according to data from the BoG. The downward trendline implies leakage of foreign currencies unrelated to everyday transactions. One possibility is capital flight from Guyana, a phenomenon that multiple factors, ranging from political uncertainty to leakage to Caribbean companies, can cause.

In 2024, the government withdrew USD $1.586 billion from the NRF. At the time of writing this essay, publicly available data indicated a single large withdrawal of USD $400 million in April 2025. One misconception is that these funds enter the domestic FX market. They never do because the funds are deposited in the overseas-based NRF when ExxonMobil and partners pay their share to the Guyanese government, and they are spent overseas when the government imports or pays contractors for building infrastructure (the contractor must import machines, steel, cement, fuel, etc.), among other external expenses. The funds that enter the FX market are primarily the exports of the non-oil economy, as well as the inflows of remittances. Importantly, a percentage of the non-oil exports will show up as commercial banks’ NFAs.

While the USD funds in the NRF are used to purchase imports, Guyanese dollars are used when the government spends on cash handouts, part-time work programs, public servant salaries, legal services, rent, and numerous other payments. The latter payments are known as non-tradable payments because they do not require US dollars. When the government makes these payments, it creates new money, which the central bank occasionally tries to offset by sterilizing it. Unfortunately, the BoG has been unable to sterilize these funds due to the way Treasury bills are auctioned. When the BoG sells Treasury bills, the proceeds are no longer deposited into the Sterilization Account but are entered into the general Consolidated Fund, thereby being available for quick absorption into the money supply.6

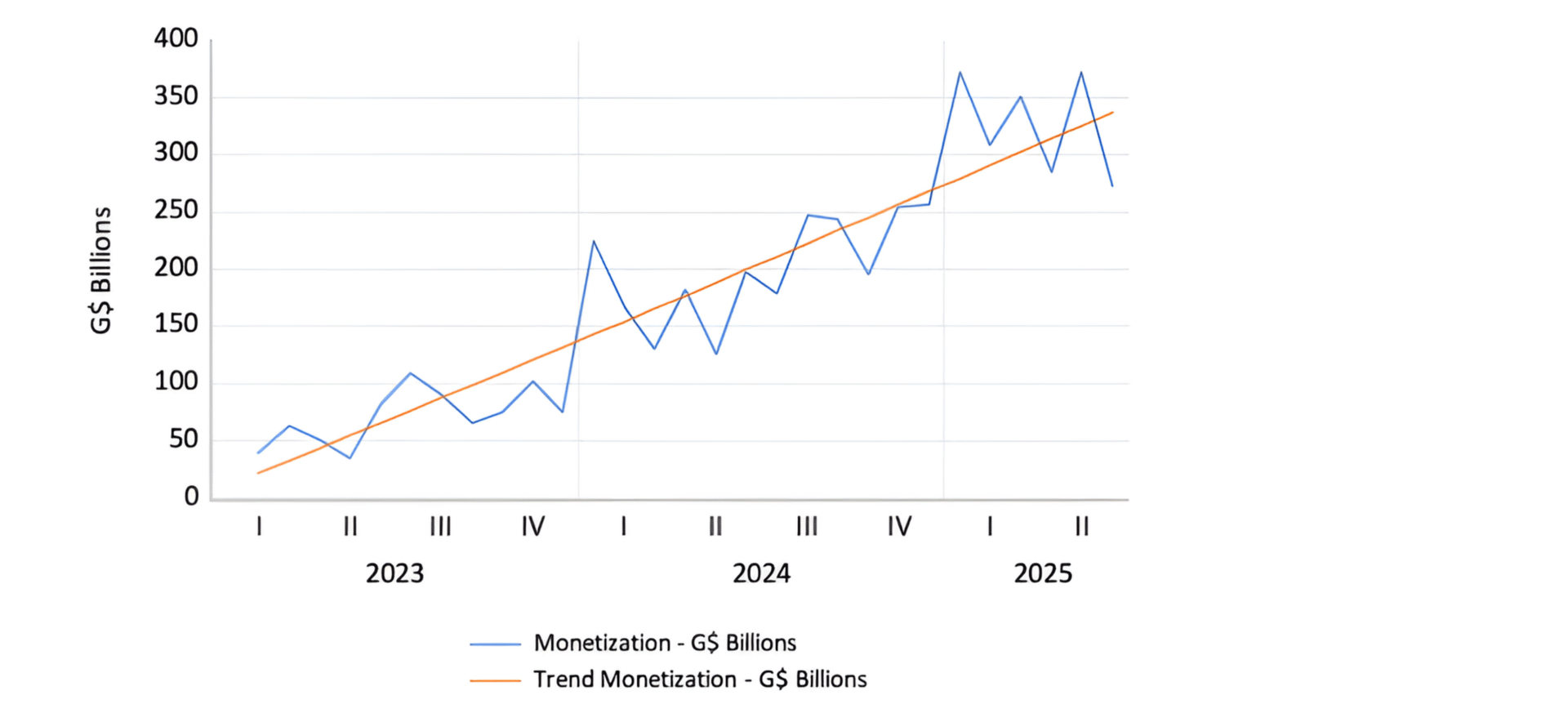

Figure 2 - Money Creation to Finance Government Expenditure on Non-Tradables

Source: Author’s calculation using data from the Bank of Guyana

Figure 2 shows the amount of Guyana dollars generated to cover the costs of these non-tradables, a process known as monetization.7 The trend line indicates a clear and persistent increase in monetization from January 2023 to June 2025. The essential point to note is that when people get paid, they demand goods and services that are primarily imported. This process creates extra demand pressure for the available stock of foreign exchange available inside Guyana.

At a minimum, two policy reforms will be needed to prevent monetization from creating unwanted FX pressures and eventually high domestic inflation relative to trading partners. The first step would be to modernize the auctioning system for government securities in anticipation of increased government spending on non-tradables. Second, there must be coordination between the treasury and the central bank to better forecast how the government’s non-tradable expenses are contributing to the money supply. Better forecasts would lead to quicker sterilization maneuvers.

1 Gevorkyan A, Khemraj T. Dominant currency shocks and foreign exchange pressure in the periphery. Review of Keynesian Economics. 2024; 12 (2): 118-146.

2 Khemraj, T. Excess liquidity and the foreign currency constant: the case of monetary management in Guyana. Applied Economics. 2009; 41 (16): 2073-2084

3 Natural Resource Fund, Quarterly Reports, June 2025. Bank of Guyana. https://bankofguyana.org.gy/bog/publications/natural-resource-fund/quarterly-reports. Accessed July 25, 2025.

4 Statistical Abstract, June 2025, Bank of Guyana. https://BankofGuyana.org.gy/bog/publications/statistical-abstract. Accessed July 25, 2025.

5 Gov’t watching US dollar flow carefully–Jagdeo. Stabroek News, Guyana News. October 31, 2024. Https://www.stabroeknews.com/2024/10/31/news/guyana/govt-watching-us-dollar-flow-carefully-jagdeo/ Accessed July 24, 2025.

6 Khemraj, T. Macroeconomics effects of a governement overdraft on its central bank account. Working Paper No. 1050, Bard College, New York,may 2024, https://www.levyinstitute.org/publications/macroeconomic-effects-of-a-government-overdraft-on-its-central-bank-account/. Accessed August 9, 2025.

7 Constantine C, Khemraj T. Political pressure and central bank monetization: Dutch disease and monetary developments in Ghana and Guyana. Pre-Print. research Gate. 2024. https://www.researchgate.net/profile/Tarron-Khemraj/research. Accessed July 25, 2025.

The information provided in this article is based on the best available sources and is intended for informational purposes only. Due to the dynamic nature of business intelligence, predictions, and analysis, there are inherent risks, including potential inaccuracies, omissions, or delays. All content in this article are provided ‘as is’ and ‘as available,’ without warranties of any kind, express or implied, including but not limited to accuracy, completeness, timeliness, or fitness for a particular purpose. Predictions and analysis involve risks and uncertainties, and we do not guarantee the reliability of the information. By accessing or using this publication, you acknowledge these risks and agree that we, our affiliates, our agents, and contributors shall not be held liable for any decisions made or actions taken in reliance on the content, nor for any direct, indirect, consequential, or special damages arising therefrom, resulting from your reliance on the information provided.